SmartFace Ups Security with Passive Liveness Detection on Live Video Feeds

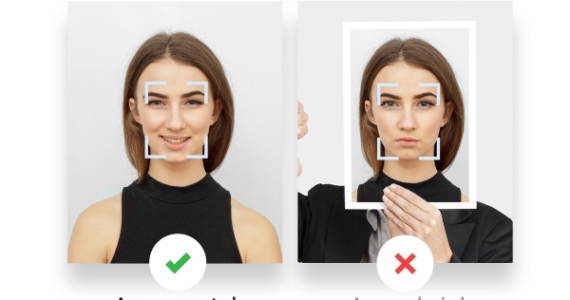

SmartFace is now capable of detecting spoof attacks in access control use cases and preventing unauthorized access to ...

Read more“If you introduce a new service, it needs to be ten times better than what it tries to replace,” said the founder of fintech unicorn Wise (formerly TransferWise), Taavet Hinrikus, at the recently concluded Trust Report Live conference. He was referring to a slew of financial companies that had tried to upgrade traditional services with new browser and app-based ones.

Nowadays, people come into contact with biometrics mostly when dealing with banks and financial institutions. Unknown to many, its reach is more widespread. Although it started with government services for security purposes such as criminal investigation and border control, biometrics has come into its own in consumer electronics. People who unlocked their iPhones with fingerprints (and later faces) have experienced the convenience right away. The expanding benefits now include paying with a touch of a finger or looking at a camera.

While face recognition is a fancy technology, fingerprints still have their place even in the era of touchless everything. The smartphone, being a personal device, is still fine to use, and new technologies are able to read fingerprints from a picture or via ultrasound. Amazon One is just one of the real-use examples of how to use biometric technology to touchlessly read biometric data from a palm.

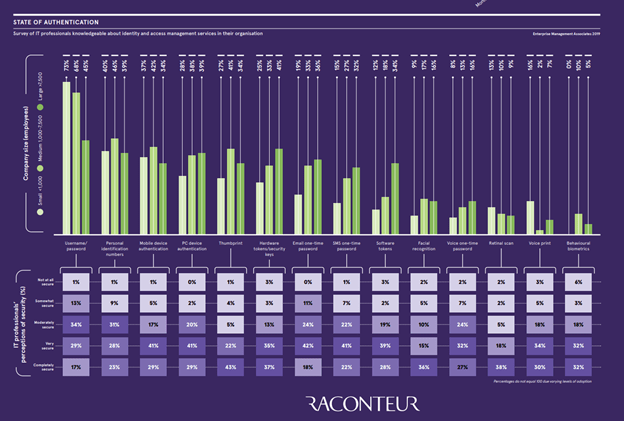

According to Raconteur, a prestigious business magazine, as many as 44% of customers prefer biometric identity verification. They now find it normal to open an account with their face or to use it to communicate with state and private institutions. Biometric verification is at the same time more convenient and more secure because clients don’t need passwords. For a long time now, they have been considered the weakest link in cybersecurity.

Numerous companies have discovered that they cannot provide their services safely if they do not have a remote form of identity verification. People also get used to such comforts quite quickly. Biometrics will therefore continue spreading into the day-to-day lives of people.

In South America, the market for biometric solutions has been steadily growing year after year. In addition to convenience, they considerably decrease the risk of identity fraud in those countries. Many countries in the region have put stringent anti-money laundering laws in place, making biometrics the ideal technology for reliable and convenient identity verification. Central biometric registers can be used not only by banks, but by other 3rd parties as well, enabling reliable identification in telecoms and other industries. One of the examples is Panama, where strong biometric authentication is central to many industries including banking.

More and more countries are integrating Innovatrics biometric solutions into their systems. “Such high demand for biometrics requires high-quality and fast products, which Innovatrics creates. When developing biometric products, we feel we are working on something useful because our products make people’s lives better,” says Peter Molčány, an integration consultant at Innovatrics.

For example, the process that was formerly designed for remote onboarding via smartphone is so convenient that banks started using it even for opening accounts in physical branches. The reason? It’s so much quicker, it’s comfortable for clients and less prone to mistakes because optical recognition doesn’t make typos when scanning documents. In some banks, all of the account openings now go this route despite the fact that only approximately a third of clients use their smartphone to open accounts remotely.

Other financial institutions use only optical recognition so they don’t have to retype the ID documents. Financial intermediaries can use facial recognition technology to make sure they have correctly identified their clients remotely – a requirement of EU regulations. In short, businesses can work smoothly and securely by using parts of the technology that make their lives easier.

For Peter, it is rewarding to see new solutions based on products by Innovatrics. “The fact that we develop various products based on different technologies means that everybody will find what suits them. Our software can run on single-chip microcomputers and mobile phones, as well as scalable server environments. People with different focus areas will find a suitable solution,” he adds.

Everyone, be it a client or a competitor, can see how Innovatrics is faring in international rankings. “Our algorithms are top-ranked. We then create a product that will meet a customer’s specific needs. Regardless if it is an attendance system, remote registration of people, keeping records of electors, or another product, our task is to develop them,” he concludes.

To learn more about our solutions, click here to get in touch with one of our biometric experts.