How to grow a business through digital customer onboarding you can trust

Contributors

Reliable customer evaluation can make or break a business, especially in finance. Learn how implementing automated identification and digital onboarding in place of manual checks put Home Credit in the leading position of a very specific market.

Looking to improve their position in the Philippine microfinance market and take advantage of ever growing demands for loans, Home Credit was facing several challenges. With ID fakes in circulation, weak internet and slow customer verification, there was ample room for improving the customer onboarding process.

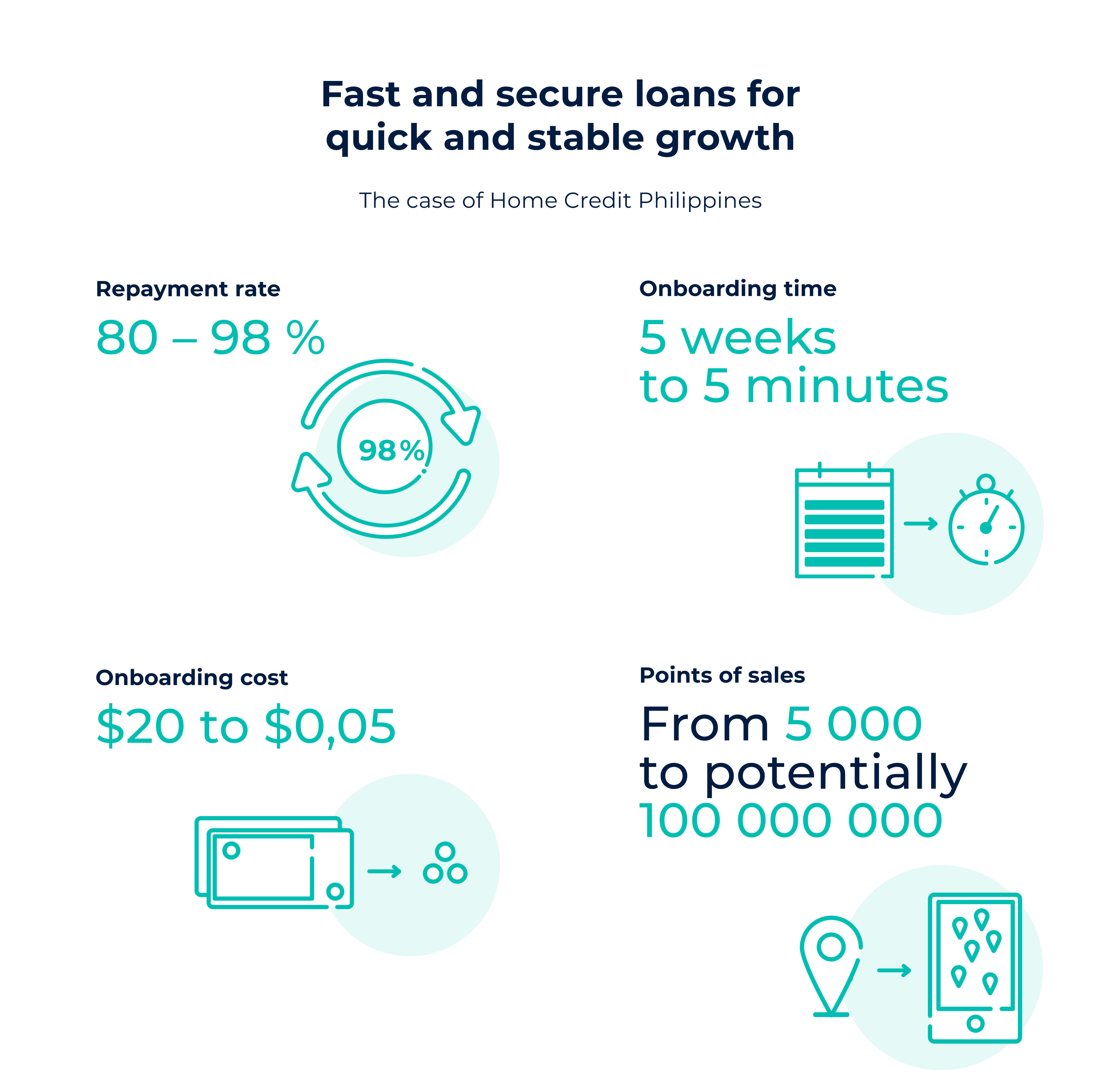

Today, Home Credit is the leading credit provider in the market. Through reliable fraud prevention and radically improving the efficiency and security of onboarding, the company was able to reach previously unavailable customers – even those unable to get a loan in the past.

The key to unlocking the market’s potential was to reliably verify the identity of the customer. And that’s where Home Credit turned to us at Innovatrics. Read on to see how we joined forces in order to help grow their market in the Philippines and gain a significant competitive advantage.

What’s inside this report:

1. Fraud, unreliable IDs and poor connectivity

How do you assess the situation?

2. A solid biometric framework

What do you need to make it work?

3. Fast and secure loans

Where do you go after it all works?

Quick check:

Is biometrics relevant for your company? It is, if you need to:

- Verify the identity of customers and establish a trusted relationship with them

- Speed up and automate customer onboarding

- Reduce staffing costs

- Eliminate human error

Banks, airports, casinos, ride-sharing services, governments – they all use biometrics to improve their business efficiency. And you?[Learn how biometrics can help your business.]

A tough nut to crack

Entering the Philippines’ loan market

Faced with the task of improving processes in a market of 110 million people spread over more than 7,500 islands with variable internet coverage, Home Credit’s Data Science Lead Jan Krpálek needed to address several issues in a single solution.

With more than 20 different IDs available both legally and illegally (a good fake costs around $20), identifying a customer wasn’t as straightforward as it would be elsewhere. Moreover, Jan had to think about how to include customers with slower internet connection and other country-specific challenges. Together with Donal Greene at Innovatrics, they set out to tackle these face to face. Literally.

Slow processes, difficult scaling

Understanding the market

Although Home Credit had had a fingerprint-based customer identification system in place since 2012, the situation in 2019 called for an improvement. Demand for microfinance products was booming – and by speeding up the processes, Home Credit could grow their business significantly, all the while helping the local population with greater credit availability.

“With the old system, customer verification took weeks and was very vulnerable to fraud attempts, raising suspicion. Poor internet and point-of-sales coverage made scaling risky and difficult to manage.”

– Jan Krpálek, Home Credit Philippines

From the customer’s point of view, getting a micro-loan before 2019 was a bit of a stretch: with uncertain results and weeks of waiting time, one couldn’t rely on getting financed in time (if at all). In the Philippines, this could easily make or break a family business.

From the technological viewpoint, we needed to answer a whole pool of difficult questions. How do you reliably verify new customers using a slow internet connection? How do you manage fake IDs in circulation? How do you cut the time needed for verification so the service is attractive? And, most importantly – how do you keep it viable for the business?

In the end, a little bit of everything was needed to make all of this fall into place. Using biometric onboarding meant every smartphone could be used as a reliable and safe identification tool, and also allowed for a complete rebuilding of the whole application process. Employing machine-learning and optimising data transmissions on top of this, made the whole thing technologically viable and reliable.

But before we could start implementing technology, we had to thoroughly understand the specifics of the challenges. Let’s look at them, one by one.

Three steps to securing a loan, the new way:

1. Submit a photo of your ID and your selfie – either in person at POS, or simply upload it on your mobile app.

2. Have your identity and creditworthiness verified within minutes.

3. You have the obtain credit and are good to go.

From manual verification to instant smartphone onboarding

The overall performance of the user onboarding process greatly depends on four key factors, each of which is significantly influenced by what identity verification system is in place.

Factor #1: Fraud avoidance

Originally, customer onboarding entailed a lengthy process of manual data processing, and was vulnerable to fraud – repeatedly. There was no reliable, permanent solution for fraud prevention. We needed something to verify the applicant’s identity against an existing database, fast.

Factor #2: Creditworthiness check

Facial recognition is useful not only for onboarding: improved identification reliability aids in accurate creditworthiness assessment, often marking the difference between getting or losing a customer. Setting up credible assessments of creditworthiness would allow Home Credit to reach previously unavailable customers and enable their financial inclusion at the same time.

#3: Resource management

Implementing facial recognition into physical points of sale would fix the most pressing issues, but it wasn’t the game changer Jan and Donal were looking for. Even if Home Credit had enough branches to reach all potential customers, the process would still require a lot of physical resources, seriously limiting business growth.

Instead of expanding the physical presence of Home Credit, they set out to develop an automated, digital solution. This would cut the verification time from weeks to minutes as well as improve safety and accuracy.

#4: Access to onboarding

While points of sale are necessary for some operations, they also have associated costs and are not infinitely scalable. Jan and Donal found the answer to business growth through enabling remote and mobile onboarding through smartphones.

“Biometric face identification coupled with the smartphone app we developed, enabled Home Credit to onboard customers remotely and automatically, requiring no human staff involvement in most cases.”

What’s more, after going through the verification once, customers could have access to Home Credit products repeatedly and at any time.

Technological challenges: speed, internet connection and costs

After understanding the shortcomings of the current system, it was Innovatrics’ turn to propose a sound technological solution. In order for Home Credit to successfully expand, the technical aspects needed to be investigated, specified and paired with appropriate solutions.

Expanding your business to a new market?

These are some points to think about if you need to verify the identity of your customers for onboarding:

1. How many legal IDs are accepted in your target country?

2. What local specifics might complicate receiving reliable identification?

3. How common are frauds and fakes?

4. How stable and widespread is the internet connection in the country?

5. Are there any onboarding processes already in place? What are their shortcomings?

6. Is there a way to digitise the whole process? How?

Challenge #1: Broad variety of legal IDs is difficult to process

As mentioned previously, legal IDs in the Philippines come in a wide range of different forms: anything from plastic cards to laminated typewritten paper. To address this, the team needed to create a system that would identify which particular ID they were looking at, extract biometric information and verify whether it’s real by matching it to associated data.

Challenge #2: Availability of cheap fake IDs helps fraudsters

A high-quality fake ID in the Philippines costs about $20. And even though institutions can flag a fraudster by their name and address, he or she can easily try it again somewhere else, using a different fake ID. This called for a quick way to process IDs and verify their validity.

Challenge #3: Local specifics complicate proper identification

A series of issues specific to the Philippines presented additional challenges for the system. This placed extra importance on proper adjustment of existing technologies to ensure reliability and repeatability of customer onboarding.

Challenge #4: Poor internet connectivity limits data transfer

You can easily get 4G in larger cities, but not so much in the rest of the country. Biometric identification requires data to be sent over the internet, but only focusing on the cities would drastically limit business reach and growth. And so, at Innovatrics we needed to come up with a very lightweight solution that doesn’t use much bandwidth.

How to tell a real face from an image or video?

Did you know there is a thing called Liveness Check that can differentiate humans from digital media? Learn more about how it works from the white paper.

Challenge #5: Profit is impacted by long durations and high costs of onboarding

If the onboarding process takes days, or even weeks, and requires a lot of manpower, the cost of onboarding a single client mounts fast. This makes the business model potentially unsustainable in the long term. Keeping costs down was therefore not only beneficial, but necessary.

Challenge #6: Relying on physical POS limits growth

Even if Home Credit managed to build and maintain tens of thousands of points of sale necessary to reach those millions of potential customers, business growth would be limited by requirements to rent branches, train and pay staff and adhere to opening hours. The only way around this was a remote, digital solution.

Many technologies, a single goal

Building a solid framework around biometric data

After firmly establishing the technological requirements, Donal assembled a team at Innovatrics to fuse several different technologies in a single, custom-built solution.

“In the end, we came up with an efficient process that Jan could trust, and that Home Credit could rely on to further improve their market position.”

– Donal Greene, Innovatrics

Biometrics enabled us to cut customer onboarding time from weeks to minutes and access a completely new segment of customers previously flagged as non-creditworthy everywhere else.

Solution #1: Sticking to the most common legal IDs covers 98% of the population

Identifying and processing dozens of different ID types is doable, but lengthy and costly to implement. However, our analysis showed that it’s sufficient to only work with 9 out of the 20 IDs, as 98% of the population owns one of these 9 documents. This alone significantly reduced the time and expenses required for implementation (and maintenance) of the proposed remote onboarding system.

Solution #2: A robust database, high-performing algorithm and machine-learning address both fake IDs and local specifics

With the right algorithms in place, verifying a person’s identity is quick and reliable, even in country-specific environments. Machine-learning ensures that the algorithm gets more accurate as it works with more data, enabling further improvement in reliability.

In the Philippines, this completely changed the rules of the game, averting fraud and building trust with a new customer base.

Solution #3: Small data packets over weak internet bring speed and reach

The remote onboarding system we used works with photographs of both the ID and the applicant’s face, so the logical assumption would be that we need to transfer both of these, sending large amounts of data even over weaker networks.

To circumvent this, we developed two solutions. First, the system crops and compresses the ID photograph to the minimum quality that still allows for the extraction of necessary data. Second, the facial recognition algorithm identifies a set of unique markers, and then turns the face into numerical code.

As a result, data packets needed for transmission of face data went from the megabyte-range a mere 500 bytes. That not only makes the whole process manageable, it also makes it fast – and available pretty much anywhere, reaching significantly more customers.

Solution #4: Overhauled processes help with onboarding

Even with the fastest processing of all necessary data, onboarding a new client will still take about five minutes, from identification and verification to signing the necessary documents at points of sale.

To get clients through this as fast as possible, the Innovatrics team improved on the POS processes to make efficient use of all the waiting time. Verification runs in the background while the clerk manages other necessary steps, and by the time all paperwork is finished, the verification is done. As a result, the customer is no longer required to wait for approval at all.

Further Reading on Facial Recognition

Facial recognition has had immense influence on both society and business in recent years. Learn more about how the technology’s fast development has changed the business landscape, as well as human behaviour in Kai-Fu Lee’s wonderful book AI Superpowers.

Solution #5: Eliminating human error improves customer services

Employing biometric verification means in most cases there’s no actual check or decision being made by human staff. As a result, people can focus on customer service and data recording, while the algorithm handles verification – significantly reducing workload, and improving accuracy.

“The algorithm is a lot more accurate in its decisions than humans are, and leaves an impeccable trail of what it evaluated, and how.”

– Donal Greene, Innovatrics

Solution #6: The only limit to scaling is the number of smartphones among the people

Ultimately, adopting biometrics means Home Credit can onboard every single customer who owns a smartphone and passes verification. The whole thing happens inside a smartphone app, which opens a great many new opportunities, both for the business and the users themselves.

How biometric solutions could help your business

The choice of whether or not to implement a solid biometric solution can, as in the case of Home Credit Philippines, make or break a successful expansion to a new market or segment, and/or significantly influence long-term business prospects.

Thanks to wide applicability and modularity, biometric frameworks can help grow businesses, improve efficiency and increase profit across a wide spectrum of industries.

More than that, biometrics may very well become the difference between those who survive, and those who get left behind. The following are some of the indications that biometric solutions could be helpful in driving your business further.

Fraud prevention is critical

If the health and security of your business heavily depends on preventing fraud – as is often the case with financial service providers – a centralised database using biometric data for customer verification can be utilised as a fast and secure solution that is easy to implement and maintain.

Customer verification is slow

Any time you need to verify your customer’s identity, it takes time, employs lots of staff, requires complex processes and generates a lot of paperwork. Whether it’s onboarding of new customers or verifying existing ones, biometrics is a powerful tool in cutting down on duration, costs and complexity of customer verification, improving speed as well as reliability.

Your employees work remotely

Depending on the industry, you might need to frequently check and verify authorisations, data access and credentials. Similarly to customer verification, biometrics can help speed up the process, while adding an extra layer of security and cutting costs at the same time.

Biometrics are in use in a variety of fields already. Some examples:

Governments

Biometrics reliably identify government employees and voters during elections.

Research laboratories

Biometric identification protects secure premises and data.

Banks and financial services

Fast and reliable customer identification and verification provides better service, prevents fraud and onboards customers faster.

Law enforcement

Numerous ways of ensuring reliable identification help during investigations and court proceedings.

Airports

Biometric identification increases overall airport security, and improves speed and ease of access.

High security requirements in your industry

If you handle lots of sensitive data and the potential risks of security breach are severe, top-notch security is a priority. From research laboratories and airports to casinos and government offices, biometric credentials can rapidly increase security and make its breach next to impossible.

Human error is costly in your industry

If your business security and profitability heavily depend on error-prevention, human factor can put it at risk, requiring you to work hard on preventing it. In such cases, biometrics can take human error out of the equation, significantly improving security and stability.

Staffing costs are too high

Due to complicated processes spanning across different teams, you may be employing more people than necessary, negatively impacting your profit and efficiency. Verification, onboarding or security clearances are good examples of where biometric solutions might automate processes, cutting down staff requirements to a minimum.

AUTHOR: Oliver Meres, Tomáš Beňadik