First of a chain of 24/7 autonomous grocery stores, driven by biometrics, opens in Slovakia

Biometrics is used as a verification method to make sure that sensitive goods such as alcohol and cigarettes ...

Read moreIn today’s world, ride-sharing services have revolutionized modern transportation, making it more convenient than ever. Now, with just one click on your smartphone you can order your ride. However, this growing industry faces significant security threats, with account takeover fraud emerging as a major concern. Almost every ride-sharing company is focusing on solutions to prevent or minimize account takeover issues and financial loss due to fraud. One of the most reliable solutions is Identity Verification (IDV) which keeps company’s operations secure and running smoothly.

As ride-sharing services and apps grow in popularity, so do the fraudsters who are eager to exploit them. Account takeover fraud occurs when a fraudster gains unauthorized access to a user’s or driver’s ride-sharing account. This can lead to unauthorized trips, financial losses, and compromised personal data. The driver is risking their rating and good standing with the platform. And the platform itself, as a company responsible for the correct operation of the service, can be liable for financial losses and customer harm, not to mention the reputation risk.

In fact, the sharing economy is a make-or-break business – according to the surveys, a full third of the customers leave a given platform if they don’t have a satisfying experience. Moreover, they tell others about their bad experiences. Word of mouth is by far the best advertising the platforms get, with 80% of potential customers willing to sign up after a positive review from their peers.

Consider this scenario: You received a notification from your ride-sharing app showing you have been charged over $500 for a ride you never took. This unexpected charge is a clear sign that someone else has accessed your account without your permission, highlighting how account takeover by unauthorized individuals can directly affect you.

Now imagine another scenario: It’s late at night and you need a ride home. You step into a taxi, and it speeds off. Do you ever pause to think about the identity and trustworthiness of your driver? These are the critical concerns that responsible ride-hailing apps center their businesses around. They work hard to ensure you feel safe, because their business relies on your trust. By listening to their customers and implementing a better identity verification process, a well-respected ride-sharing app increased its revenue by 16% in 2023.

This trust is not to be underestimated. These companies expend significant resources in terms of time and finances to ensure passenger safety. Driver verification, i.e., making sure you get a ride from the same person displayed in the app, is one of the most important aspects of building and maintaining trust. The drivers also benefit from rider verification via their higher safety. With the highly competitive market the platform that gives highest security to their service providers is going to benefit in the long run.

Identity Verification is a process that compares the identity of what a person claims to have with the supporting documentation they possess. In the past, identity verification was manually conducted from paper-based documents to passport and photo identification. As technology has enabled increasingly sophisticated ID verification systems and techniques, methods have expanded to include online identity verification, biometric identity verification, facial recognition, and more.

Identity verification technology needs to go beyond username and password, especially because this is simply not a reliable way of ID verification. Biometrics can often be the ideal way with facial verification or fingerprint matching readily available in every smartphone. ID verification can be done online and offline, in person or remotely, depending on the circumstances.

There are several different methods important to verify an individual in ride-sharing:

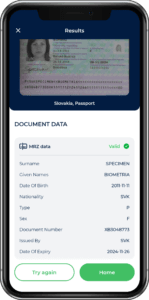

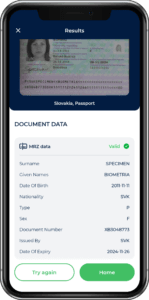

In document verification, having a valid ID card, driver’s license, or passport is crucial. These documents not only confirm the person’s identity but also ensure the authenticity and legitimacy of the information provided. The system verifies the authenticity of an ID photo, contact details, stamps, watermarks, QR codes, MRZ code, and fonts. The system leverages automation and advanced AI to analyze uploaded documents. The process also checks that documents are up to date and that they are still valid and contain the most recently updated information. By training models to detect and read particular document features, and by assessing elements like liveness, we ensure that the documents are genuine and haven’t been fake or forged.

The role of a liveness check is to make sure the system is dealing with actual people, not fake images. To illustrate its importance, this is a typical scenario where a liveness check proves critical: Imagine a driver banned because of consistently bad reviews. They don’t want to lose their income, so they create a new account in their friend’s name and ID. They also have a few photos of this friend on their phone. When they’re prompted by the system to verify their identity by taking a selfie, they simply use the friend’s photo, and that’s it, right? Well, not with a proper liveness detection.

The NFC verification process is one of the most reliable ways to verify an identity document. In ride-sharing services, NFC verification can identify any document with an embedded RFID chip, assuring 100% proof of the document’s authenticity.

The users must have a smartphone with built-in NFC functionality and an NFC-enabled identity document. With this cutting-edge identity verification method, ride-sharing platforms can ensure that only verified users gain access to accounts, drastically reducing the risk of fraud.

Explore the user experience and test insights of Innovatrics NFC Verification process.

Imagine bringing new users on board quickly and effortlessly, all while confidently keeping fraudsters out—that’s the magic of advanced identity verification solutions. They can help in many sectors like finance, healthcare, or any industry that handles sensitive information and data.

Let’s dive into the benefits that this technology can bring to business operations and customer relationships:

By verifying the identity of users through these solutions, it becomes significantly harder for fraudsters to take over accounts.

If a fraudster tries to steal a user’s login credentials from a ride-sharing app, the advanced identification process steps in. It can ask for additional information, like facial recognition or fingerprint verification, effectively stopping the fraudulent login attempt in its tracks.

When users know that a ride-sharing platform applies identity verification measures, their trust and confidence increase. Both drivers and passengers feel more secure knowing that the individuals they interact with have been verified. This can have a positive impact on the brand reputation and potentially higher user adoption rates.

According to McKinsey Digital Trust Insights, 53% of consumers will be looking for companies that have a reputation for protecting customer data. When companies—especially ride-sharing platforms—implement identity verification, they often see a 10-15% boost in customer satisfaction. Customers feel safer and more confident using services that prioritize their security, which leads to a more positive overall experience.

Many countries and regions have different regulations regarding data protection and user identification within the ride-sharing industry. Identity verification technology helps platforms comply with these regulations.

Know Your Customer (KYC) regulations are part of identity verification solutions that can support businesses to verify the identity of their customers. Every country and region has implemented different laws and regulations obligating businesses to implement them to prevent fraud, money laundering, and terrorist financing.

Having this in mind there are many important KYC Compliance processes that companies worldwide need to follow and implement. Here are a few of them:

Account takeover fraud often leads to financial losses for both the platform and its users. Advanced identity verification technology helps minimize these losses by preventing fraudulent transactions. When a fraudster gains access to a rider’s account and takes unauthorized trips, the rightful user often disputes the charges. This not only frustrates the user but also results in costly chargebacks for the platform.

According to the Lyft Transparency Report, between 2020-2022 after the implementation of continuous criminal background checks of drivers and real-time identity verification, their financial losses were reduced by 22%. They even address that over 99% of all rides occur without any safety report at all.

This shows that by implementing verification solutions, businesses prevent unsafe scenarios, reducing chargeback rates and associated costs. The positive impact of this step will be improved profitability, a better and more sustainable business model, and lower operational costs.

With identity verification technologies becoming essential for ride-sharing platforms, companies can effectively fight account takeover fraud scenarios. However, we need to continue improving the solutions because with the rise of AI, fraudsters adopt advanced tactics, such as deepfakes or phishing schemes.

At Innovatrics, we constantly strive in providing cutting-edge identity verification solutions that serve the unique needs of ride-sharing companies. With 20 years of expertise in biometrics and AI, our identity verification toolkit is fully developed in-house to ensure quality and reliability.

Reduce the possibility of account takeover fraud by experiencing our solution in action.